Table of Contents

70% of enterprises unwillingly lose a staggering 30% of their customers. These customers usually leave without saying a word. So is there anything we can do to avoid this customer churn? In our modern world where data is crucial, using data analytics is not just a good idea, it’s a must. It helps us understand, predict, and stop customers from leaving. Let’s explore how data analytics can guide you in today’s data-heavy world.

Understanding Customer Churn – Why It Matters

At its core, customer churn signifies the rate at which customers discontinue their association with a company over a specified time frame. It embodies the process through which customers, once engaged and contributing to profitability, transition into disengagement, and potentially evolve into missed business opportunities. The manifestations of churn vary, ranging from the inconspicuous withdrawal of subscribers from a streaming service to the gradual decline in purchases from long-standing patrons.

The question arises: Why does customer churn hold such a paramount position as a business metric, deserving of our unwavering attention? The answer to this inquiry resides in the far-reaching consequences it exerts across diverse industries and commercial sectors.

- Revenue Attrition: Churn leads to immediate revenue loss and forfeited future earnings as departing customers disengage.

- Acquisition Costs: Elevated churn forces enterprises to invest heavily in acquiring new customers, often more resource-intensive than retaining existing ones.

- Reputation and Trust: In our interconnected world, customer dissatisfaction can rapidly tarnish a brand’s image, underscoring the importance of trust and reputation for sustainable growth.

- Sustainable Advancement: Elevated churn disrupts this equilibrium, hindering long-term expansion.

- Competitive Superiority: Effective churn management bestows enterprises with a competitive edge, safeguarding their customer base.

The Data Analytics Approach

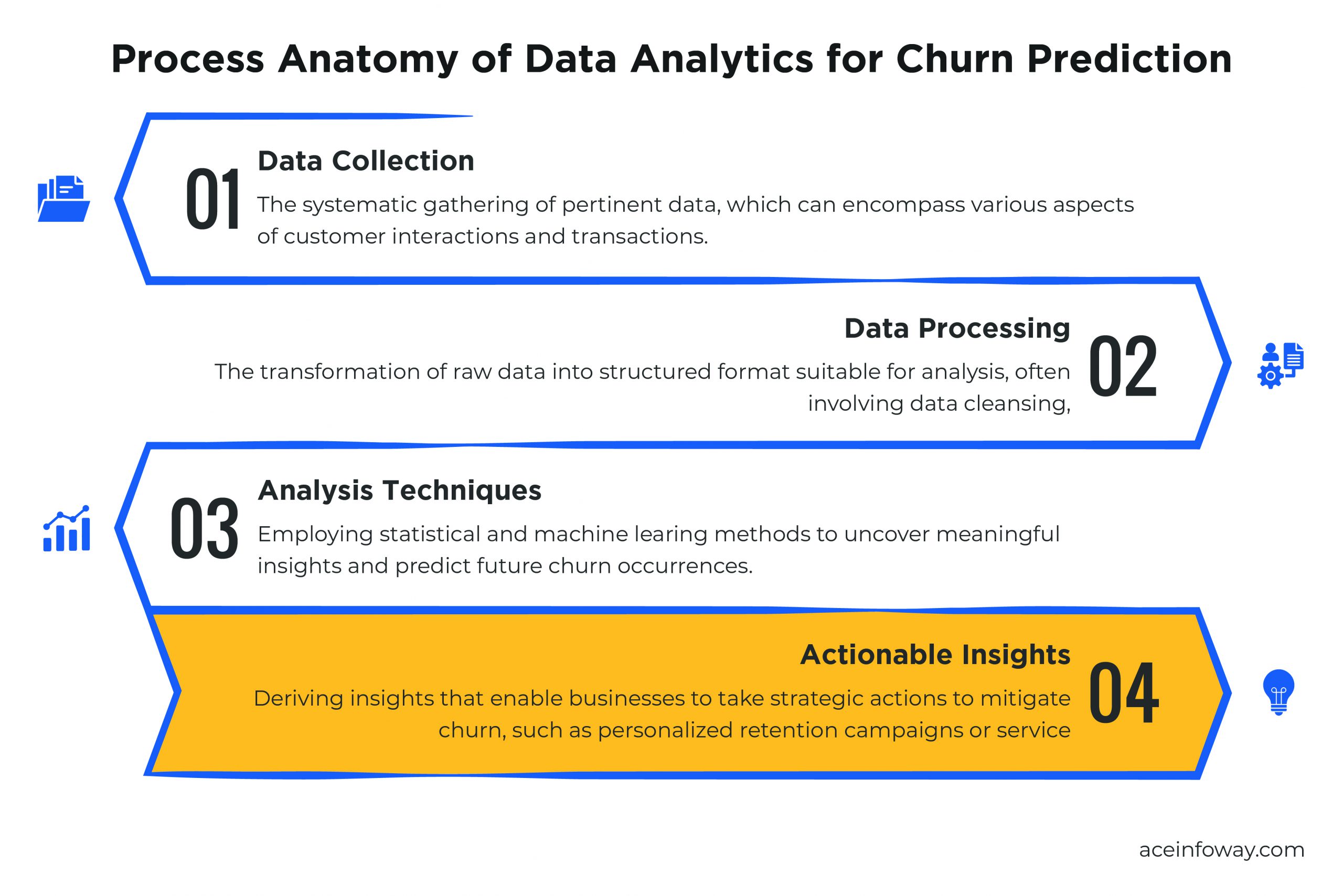

Data analytics is the art and science of mining actionable insights from raw data, enabling businesses to make informed decisions and predictions. In the context of customer churn analysis, data analytics empowers us to sift through vast datasets to discern patterns, correlations, and trends that might otherwise remain concealed.

Approximately 50% of customers experience natural churn every 5 years. Surprisingly, only 1 out of every 26 dissatisfied customers actually voice their complaints; the majority quietly churn. Churn analysis thrives on a rich tapestry of data sources, each offering a unique perspective on customer behavior and satisfaction. The combination of these data types is essential for constructing a comprehensive understanding of churn dynamics. Here are some pivotal categories of data frequently leveraged in churn analysis:

- Customer Data: This includes demographic information, customer profiles, and contact details. Understanding the demographics of customers who churn can inform targeted retention efforts.

- Behavioral Data: Tracking customer interactions with products or services. It encompasses data on purchases, usage patterns, website visits, app interactions, and more. Behavioral data unveils the ‘how’ and ‘why’ behind churn.

- Transactional Data: Records of customer transactions, such as purchase history, payment methods, and transaction frequency. Analyzing transactional data can unveil spending patterns and identify potential churn triggers.

- Customer Feedback: Information gathered from surveys, customer support interactions, and social media sentiment analysis. Feedback data provides insights into customer satisfaction and areas requiring improvement.

- Usage Data: Metrics related to how customers use a product or service. For software applications, this could be feature usage, session duration, or login frequency. Understanding usage patterns can pinpoint potential issues or areas of disinterest.

The strength of any data analytics endeavor lies in the quality of the data upon which it relies. Poor-quality data can lead to inaccurate conclusions and misguided strategies. Therefore, ensuring data quality and preprocessing are pivotal steps in the churn analysis journey.

Predictive Analytics for Churn Prediction

9 out of 10 consumers appreciates it when a business is familiar with their account history and current interactions. In our journey to combat customer churn, predictive analytics emerges as a formidable ally. Let us delve into the technical intricacies of predictive analytics, demystifying the concept and laying out a comprehensive roadmap for constructing a churn prediction model.

Predictive analytics is the process of using historical and real-time data, statistical algorithms, and machine-learning techniques to anticipate future outcomes or behaviors. In the context of churn prediction, it empowers businesses to forecast which customers are at risk of churning before it happens, allowing for targeted retention efforts.

Building a Churn Prediction Model: Step by Step

- Data Gathering and Preprocessing: This involves gathering relevant customer data, including behavioral, transactional, and demographic information. The data must be cleaned, transformed, and integrated to ensure accuracy and consistency. Data quality is paramount at this stage, as predictive models are only as reliable as the data they are built upon.

- Feature Selection and Engineering: It involves choosing the most relevant data attributes that are likely to influence churn. Feature engineering may also be necessary, where new features are created from existing data to enhance predictive power. For instance, calculating a customer’s average purchase frequency or engagement score.

- Model Selection: Choosing the right predictive model is a critical decision. Various techniques can be employed, including logistic regression, decision trees, random forests, support vector machines, and machine learning algorithms like gradient boosting or neural networks. The choice depends on the nature of the data and the complexity of the problem.

- Model Training and Validation: With the model selected, it’s time to train it on historical data. This process involves feeding the model with past churn and non-churn cases to help it learn the patterns and relationships within the data. Once trained, the model needs to be validated using separate data that it hasn’t seen before.

Model evaluation metrics are the yardstick by which the performance of a churn prediction model is measured. These metrics provide quantifiable insights into how well the model is performing and its ability to predict churn accurately. Some crucial model evaluation metrics include:

- Accuracy: To measure the overall correctness of predictions, indicating the proportion of correctly classified instances.

- Precision: To evaluate the accuracy of positive predictions, highlighting the proportion of true positives out of all positive predictions. Precision is vital when false positives are costly.

- Recall (Sensitivity): To measure the ability of the model to correctly identify all relevant instances, representing the proportion of true positives out of all actual positives.

- ROC AUC (Receiver Operating Characteristic Area Under the Curve): To represent the model’s ability to distinguish between churn and non-churn cases. A higher ROC AUC indicates better model discrimination.

- F1-Score: The harmonic mean of precision and recall, providing a balanced measure of a model’s performance.

Effective model evaluation helps fine-tune the predictive model, optimizing its performance for real-world churn prediction scenarios. It also aids in making informed decisions about resource allocation for customer retention strategies.

Preventing Churn With Data Insights

Data analytics acts as a beacon, illuminating the network of customer behaviors and interactions. It enables us to sift through vast datasets to discern the specific factors contributing to churn. By analyzing patterns and correlations, data analytics can unveil the ‘whys’ and ‘hows’ behind customer attrition. For example, it can identify whether high shipping costs, long waiting times for customer support, or a particular product feature are more likely to lead to churn.

Once the contributing factors are identified, the true power of data analytics comes into play—proactive customer retention. Armed with insights derived from data, businesses can tailor their strategies to prevent churn before it occurs. This involves anticipating customer needs, addressing pain points, and enhancing the overall customer experience.

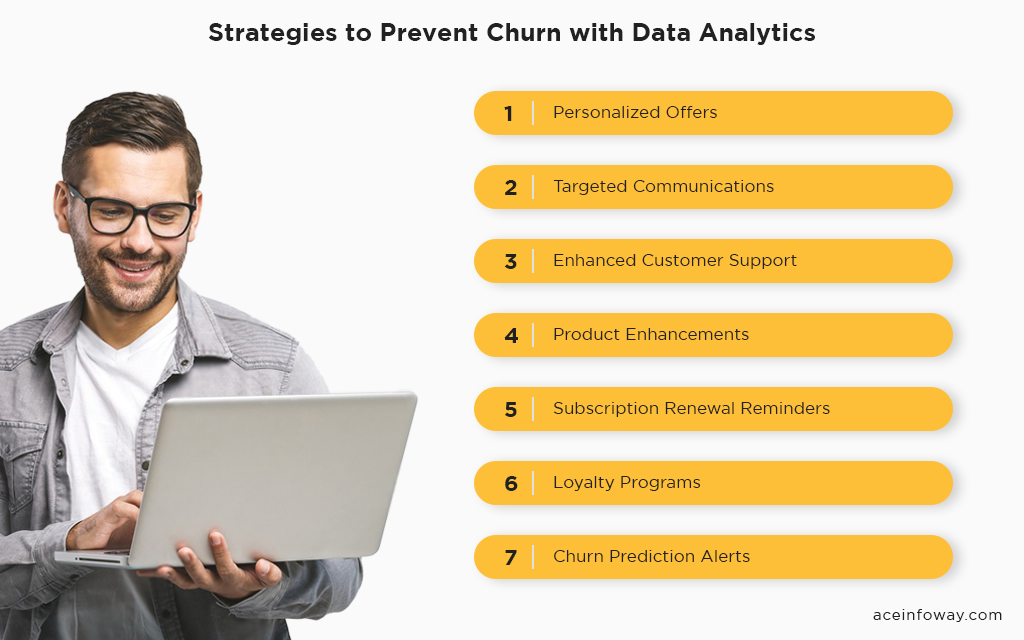

Let’s delve into concrete examples of strategies that can be derived from data-driven insights:

- Personalized Offers: By analyzing purchase histories and preferences, data analytics can help create personalized offers and discounts tailored to individual customers. These incentives can be strategically timed to re-engage customers at risk of churn.

- Targeted Communications: Data insights enable businesses to segment their customer base effectively. For instance, identifying customers who haven’t interacted with the brand recently can prompt tailored re-engagement campaigns, reaching out through email, social media, or other preferred channels.

- Enhanced Customer Support: Through data analytics, businesses can identify common pain points in the customer support journey. This can lead to improvements in response times, issue resolution rates, and overall customer satisfaction.

- Product Enhancements: Analyzing usage data and feedback can guide product development efforts. Identifying underutilized features or areas where customers frequently encounter difficulties can inform updates that increase product value and satisfaction.

- Subscription Renewal Reminders: For subscription-based services, data analytics can predict when a customer’s subscription is likely to expire. Automated reminders and tailored renewal incentives can encourage customers to stay on board.

- Loyalty Programs: Data-driven insights can pinpoint high-value customers and their preferences. This information can be leveraged to create loyalty programs that reward frequent patrons and incentivize long-term commitment.

- Churn Prediction Alerts: Real-time churn prediction models can generate alerts when a customer shows early signs of churning. This allows businesses to intervene promptly with retention strategies.

By applying these strategies, businesses can not only reduce churn but also cultivate a loyal customer base that actively contributes to revenue growth. Data-driven insights serve as the compass guiding these efforts, ensuring that resources are deployed where they will have the most significant impact.

Wrap-Up

Customer churn can silently erode revenue and tarnish a brand’s reputation. Yet, it’s also an opportunity to leverage the transformative capabilities of data analytics to not only predict and prevent churn but to nurture lasting customer relationships. Imagine being able to foresee potential churn before it happens, to understand precisely why customers may be slipping away, and to respond with precision and empathy. It’s not a dream; it’s a reality enabled by data analytics.

Whether you are a small startup, a growing enterprise, or an established industry leader, the power of data analytics is within your reach. Our team is here to help you unlock this potential, to navigate the intricacies of data collection, analysis, and strategic implementation.